Because we are Real Estate Brokers you probably think we try to talk people into selling their home. That isn’t true, but what I do try to do is make sure people who contact me aren’t staying where they are due to misunderstanding how financial things work. This month there were 2 misunderstandings that seemed to come up frequently so I wanted to address them with you, too.

Misunderstanding #1 – If You Sell And Buy Another Home Your School Taxes Will Go Up

This is a comment a friend made to a post on Facebook.

"In Texas it rarely makes sense for a long-time boomer homeowner to sell a home to attempt to downsize because the frozen school taxes keep many in their older home."

Here was my response...

"Thanks for bringing that up. I always say if it makes sense and solves your problem they should move. If not they shouldn’t.

Your comment is a common misunderstanding. How it actually works is if someone transfers their over 65 exemption to another homestead property in Texas they get to transfer their savings based on a %.

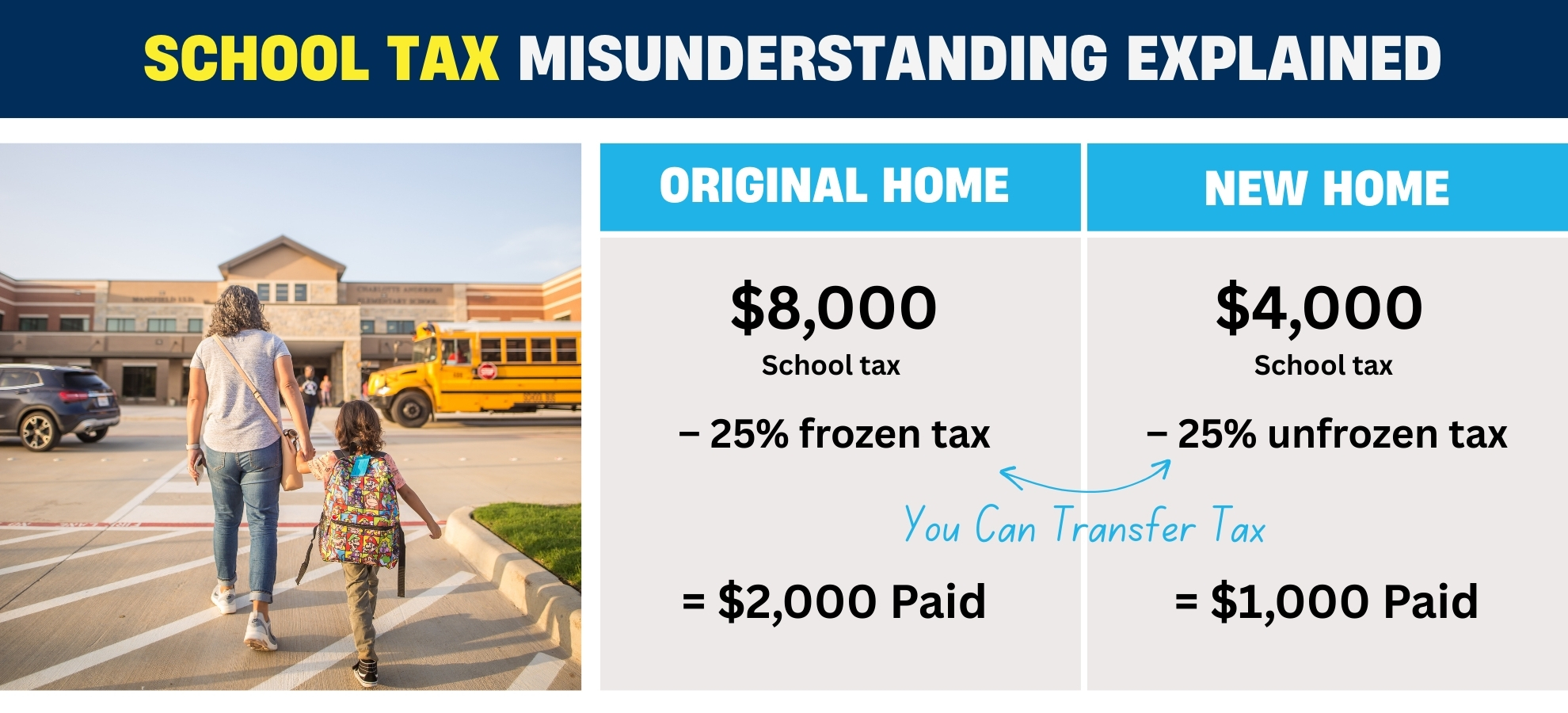

Let’s say someone would pay $8,000 in school taxes but because they have been frozen they only pay $2,000 (25%). If they buy another house they can transfer that percentage and they will pay 25% of what the school taxes would be without the freeze. If the school taxes normally would be $4,000 for the new house they would pay $1,000 ($4,000 x 25%).

None of this means someone should move if it doesn’t make sense and solve their problem, or if it’s not the right time. It’s important for people to understand how it works so they can make the best decision based on correct information."

Misunderstanding #2 – You Don’t Have To Buy Another House

Many of our clients haven’t sold a home in a long time. The last time they sold a home there was a requirement to qualify for the capital gains exclusion you had to buy another home. That is no longer true.

If you are selling a home you have lived in for 2 of the previous 5 years you should qualify for the capital gains exclusion of $250,000 per person ($500,000 per couple). You do not need to roll your profit into another home or buy another home at all to qualify for the exemption.

Thinking About Selling Your Home?

If you’re planning to sell your home in Austin, Cedar Park, Round Rock, or the surrounding area, decisions like whether to replace your roof can feel overwhelming. That’s where we can help. At Kopa Real Estate, we guide homeowners through the selling process, including which repairs or updates will give you the best return on investment.

Contact us today to schedule a consultation and find out the smartest steps to get your home market-ready.

If you plan to sell your home, now is the best time to attend our Free Home Selling Seminars. If you want to attend a seminar, contact us, and we will notify you when they are scheduled. As always, you can check KopaSeminar.com to see the dates and times of our in-person and online Free Home Selling Seminars. For years, home sellers have told me they benefited from attending our events. Sign up for our Free Home Selling Seminar in Austin or Cedar Park at KopaSeminar.com.

Leave A Comment